Principles and management of corporate responsibility

Finnfund’s special development policy mandate is to generate positive development impacts in the target countries. Finnfund promotes corporate responsibility both within its own and its partners’ operations.

Responsibility for the economic, social and environmental impacts of operations, as well as transparency and good governance are key factors in Finnfund's decision-making.

Finnfund’s special mandate and development policy mission

Finnfund’s mission is to promote economic and social development in developing countries by financing responsible private business operations on a self-supporting basis. The purpose of the company is not to generate profit for the shareholders.

Finnfund provides its customers with equity capital, long-term investment loans and expertise on operations in developing countries.

At the end of 2017, the State of Finland owned 93.8 percent of Finnfund’s share capital, Finnvera plc 6.1 percent and the Confederation of Finnish Industries (EK) 0.1 percent. Finnfund is an entrusted company with a special assignment by the State and belongs to the administrative sector of the Ministry for Foreign Affairs. The detailed content of the company’s special development policy mission is assigned annually by the Ministry for Foreign Affairs on the basis of the development policy programme currently in force.

Finnfund is governed by the Act on a Limited Liability Company named Teollisen yhteistyön rahasto Oy (291/1979, the “Finnfund Act”).

The Ministry for Foreign Affairs defines Finnfund’s special development policy mandate and sets goals for the company in terms of Finnish development policy, financial profitability and cost-efficiency. The Ministry for Foreign Affairs annually monitors the success of these goals.

The goals set by the Ministry for Foreign Affairs and their success are reported to the company’s Board of Directors, which participates in guiding the company’s operations in accordance with the goals set for it.

The company believes that in 2017 it was successful in achieving and largely exceeding the main objectives set for it. This refers to the operations being cost-effective and having positive development impacts, the share of investments in lower and lower-middle income countries among new decisions; and the part of projects that directly benefit the poor among all the decisions made. The company’s own profit on equity remained below the target level set by the ownership steering, however.

Finnfund’s mission is specifically to support the development of the private sector and to improve its operating conditions in developing countries in a manner that promotes economically, socially and environmentally sustainable development.

Finnfund funding is often a leverage and mobilizes more funding for projects that otherwise might not be realized. At the same time, Finnfund seeks to strengthen the development impacts of the investments and to increase environmental and social sustainability. In practice, this means, for example, assessment of sustainabilty and impacts prior to investment decisions as well as aligning payments to implementation of corporate responsibility.

Finnfund also manages the Finnpartnership program, funded by the Ministry for Foreign Affairs, on a contractual basis. Finnpartnership offers financing, contacts and advice to explore business opportunities in developing countries. The services are intended for companies, educational institutions, NGOs and other actors.

In 2017, a new strategy until the year 2025 was prepared for Finnfund. The objective of the strategy is to develop Finnfund as a pioneer in impact, and to support the coherent future development and growth of the organisation as it increases in size and recognition.

In connection with the strategy process, the company’s mission and vision and the key breakthroughs needed to achieve these were defined. The vision for Finnfund is to achieve the position of a valued partner and a pioneer in impact in European development financing by the end of 2025. In order to achieve this vision, Finnfund must increase the impact of its operations, manage its reputability, extend its financing base, and reform its work culture.

In 2017, a new strategy until the year 2025 was prepared for Finnfund. The objective of the strategy is to develop Finnfund as a pioneer in impact, and to support the coherent future development and growth of the organisation as it increases in size and recognition.

In connection with the strategy process, the company’s mission and vision and the key breakthroughs needed to achieve these were defined. The vision for Finnfund is to achieve the position of a valued partner and a pioneer in impact in European development financing by the end of 2025. In order to achieve this vision, Finnfund must increase the impact of its operations, manage its reputability, extend its financing base, and reform its work culture.

Finnfund’s values

The values guiding Finnfund’s operations have been determined in cooperation with the entire personnel. These values are:

Responsibility

- We finance responsible business operations in developing countries.

- The Finnfund team always does its best.

Respect

- We respect different cultures, their people and their ways of working.

- We appreciate each other and the work done by others.

Development

- We have the courage to develop new ways of working under challenging conditions.

- Finnfund supports and encourages its team in continuous development and learning from experience.

Effectiveness

- Our successful investment projects reduce poverty and inequality.

- We focus on the essentials and use our resources as effectively as possible.

A set of common ground rules has been derived from the values in order to make them a more tangible part of the daily work of all Finnfund employees. Implementation of these values by the company and in the activities of all employees is assessed annually in development discussions.

More about Finnfund under the section Finnfund in brief.

Finnfund’s principles of corporate governance are described in the 2017 Annual Report under the Corporate governance section.

Management and resourcing of corporate responsibility

In 2017, the Managing Director lead environmental and social risk management in cooperation with the Director of Portfolio and Risk Management and the Director of Impact. The Board of Directors monitors corporate responsibility as part of the company’s operations.

Experts on environmental and social responsibility, development impacts, corporate governance and tax liability ensure that the risks and impacts are assessed and monitored throughout the project lifecycle in all projects funded by Finnfund. The Development Impact Advisers create a preliminary assessment on the impacts of each funded project and monitor and report on the impacts throughout the project life cycle.

In addition, they continuously develop Finnfund’s methods and working processes and cooperate with international expert networks and provide training to the other employees whenever necessary.

All employees comply with the company’s corporate responsibility principles.

As a result of an organizational reform carried out during 2017, environmental and social advisers and development impact advisers were transferred to work under the same Risk management and impact unit. In addition, a Manager for the Environmental and social responsibility team was appointed. With regard to good governance and tax liability, the responsibilities are divided for the investment operations, risk management and impact, and legal affairs.

Principles and practices of environmental and social responsibility

Both Finnfund’s and its investee companies must aim at environmental and social sustainability in all of their operations. Assessment and management of environmental and social impacts are central to Finnfund's financing process.

Finnfund’s first Environmental Policy was approved by the company's governing bodies in 2005. In 2013, the Environmental Policy was reshaped into an Environmental and Social Policy, which was updated in early 2016. The Policy is available on the Finnfund website.

In addition, an internal handbook on environmental and social responsibility describes the assessment procedures and responsibilities. Project assessment, follow-up and corrective actions take place accordingly. Assessment and monitoring applies to all projects and their subcontracting chains. The handbook is updated continuously: the last and third version was updated in 2016.

Finnfund’s Environmental and Social Policy is based on compliance with international standards and the Finnfund strategy. In 2009, Finnfund endorsed the principles for responsible financing of the Association of European Development Finance Institutions (EDFI) and committed to implementing them in its operations. The EDFI principles are aligned with the ten principles of the UN Global Compact initiative.

In the autumn of 2011, Finnfund and 24 other development finance institutions signed the Corporate Governance Development Framework, including a common set of guidelines on promoting good corporate governance in the investee companies, thus supporting sustainable economic development in developing countries. Finnfund is also committed to the UN Guiding Principles on Business and Human Rights and the fundamental principles of the International Labour Organization (ILO).

In 2017, Finnfund prepared a new tax policy that was introduced from the beginning of 2018. More information under the section Financial responsibility.

|

Working for environmental and social sustainability Environmental sustainability refers to aiming for a circular economy model, including economical use of raw materials, recycling, protecting the environment against pollution and climate change mitigation, and preventing the loss of biodiversity. |

When considering funding a project, Finnfund pays special attention to the identification, management and mitigation of environmental and social risks as well as to the strengthening of positive impacts. Sustainability is monitored, evaluated, and developed as needed throughout the project lifecycle. As a part of the monitoring phase, Finnfund’s experts also visit the projects and, if necessary, use external experts to support the monitoring.

In the assessment of the environmental and social risks and impacts of the projects, in compliance with its environmental and social policy, Finnfund complies with the standards of the International Finance Corporation (IFC, member of the World Bank) and the European Development Finance Institutions (EDFI). Finnfund is committed to the principles of UN Global Compact, the UN Guiding Principles on Business and Human Rights and the Fundamental Principles of the International Labour Organization (ILO).

To be eligible for Finnfund’s financing, a project must comply with local legislation and all environmental and social responsibility requirements laid down in the international standards applied to the project. Each company financed must commit to assessing risks and impacts of company operations, creating and implementing an environmental and social management system that covers its operations and supply chain, guarantee sufficient expertise in management of environmental and social responsibility and submit regular reports on its environmental and social management to Finnfund.

In 2017, Finnfund developed, inter alia its environmental and social responsibility monitoring, human rights impact assessment and monitoring tools, and decided to launch a reform of its human rights policy. Finnfund also started calculating the carbon footprint of the whole portfolio.

During the year, Finnfund organized training for its personnel e.g. on human rights and the UN Guiding Principles on Human Rights (UNGP), sustainable forest certification and tax liability.

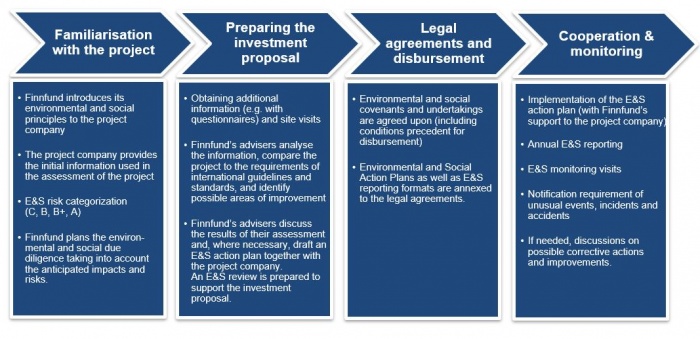

Environmental and social responsibility in Finnfund's financing process

Stakeholders and stakeholder interaction

The company’s most important external stakeholders include the owners, companies that Finnfund finances, key development policy operators (including non-governmental organisations), operators in the Finnish business sector (the company’s client organisations in particular), the company’s European sister organisations and co-investors. Other important stakeholders also are on a case-by-case basis, and other parties related to the projects financed by Finnfund, such as local communities, authorities and civil society in the target countries.

Finnfund aims to maintain regular and open interaction with its various stakeholders, to discuss its operations and principles openly both at a general level and in terms of specific projects. Finnfund aims to maintain regular and open interaction with its various stakeholders to identify their expectations and possible concerns and to openly respond to these.

In 2017, Finnfund continued to strengthen the dialogue with various stakeholders both in Finland and internationally. During the year, Finnfund held discussions and meetings on various themes, such as the situation in Myanmar and tax liability. An annual meeting of European Development Financiers (EDFI) was held in Helsinki in May.

Read more:

• Development impact

• Financial responsibility

• Social responsibility

• Personnel

• Environmental responsibility

• Investments

• Key figures

• Managing Director's report